Reduce Healthcare Spend while Improving Benefits

Self-funded employee benefit plans.

Healthcare is a topic that we all struggle with-it is usually the third or fourth largest expense that a firm faces and it is one that we don’t understand, can’t forecast it, never get good news and every decision impacts employees and their families as well as the retention and recruitment. HR thinks we just look at the numbers and don’t care about the impact upon employees, recruiting and retention and just squeeze the cost increases onto the employees! Ironically, in privately held firms under 50 million in sales or under 200 employees, frequently the CFO is responsible for HR!

To make it worse, we don’t know who to turn to, what information to believe, who to believe and just don’t know what to do and our expectations are conditioned by our brokers and the media.

This chapter starts with basic information that we need to know and introduces ideas that CFOs should learn more about. We started with understanding the cost stack, reviewing what comprises the costs (routine services including annual examinations (an obvious best practice), inpatient and outpatient services and pharma costs) and understanding the costs, risk and trends in each category.

As in any cost that we analyze, once you understand the cost stack components, we can understand our outliers, our unique circumstances and start to analyze alternatives. You can’t analyze cost without analyzing risk so we have provided information on the risk drivers and ways to eliminate that risk.

A Deeper Look…

The inherent conflict of interest between broker and client.

At this point, it was obvious that our brokers and advisors don’t generally provide this information and we started to wonder why. The realization was that insurance brokers have goals that are inconsistent with our goals – we want to provide quality healthcare to our employees, their families and to attract candidates at an affordable, predictable cost with understood risks whereas the brokers and insurance carriers want to increase revenue and profits.

Every business needs strong and stable suppliers and we can usually evaluate and compare suppliers because we understand what they sell to us and have information that we can analyze. The irony is that more information exists on healthcare costs than any item in our economy yet we can’t seem to get the information. We focused on this goal incongruity as a touchstone.

We provided information on the cost stack, trends and risks and we have provided introductions to the people behind the best practices. We have brought in nationally acclaimed advisors as we have brought in highly respected local healthcare brokers. Our observations were shocking – the brokers explained their version of the information, what separate a broker from a good broker and justified the double digit cost increases. Cost information was not stressed, best practices were not introduced and the cost saving alternatives they presented were minuscule such as a per capita admin charge per month.

The best practice experts presented the cost drivers and presented proven ways to reduce OR eliminate risks in the offerings or ways to reduce costs significantly. For example, we analyzed mail order prescription costs and learned about a radical alternative to the big box solutions-a transparent, virtual pharmacy that is cost based, true costs-no hidden rebates, elimination of the PBM elephant in the room with double digit savings for employees and the employer! We wondered why our brokers didn’t tell us about this alternative and we discovered that they did not have access to this solution-because driving down pharma costs was not consistent with their commission and rebate model! This was evidence of goal incongruity and the widespread similarity of renewals between local brokers!

Along the way, we have learned about the cost stack and the associated risk profiles with each of the cost components. We all know that risk is the cost driver-any way to reduce risk will quickly translate into lower costs, less uncertainty and help to manage future costs addressing all of our concerns as well as the concerns of Human Resource executives and the employees. We learned that some of the popular offerings have not proven themselves-the in vogue wellness programs have not proven themselves and programs to increase annual exams, smoking cessation and weight loss have been more easy to promote but have had limited success –as evidenced by the continuation of cost increase, benefit reductions, cost shifts to employees year after year.

Conclusion

Find a healthcare consultant with aligned goals.

The conclusion is that goal alignment is key. We believe that working with a consultant who is aligned to provide better solutions at lower costs, and gets compensated providing quality healthcare at lower costs, instead of working with a broker and a carrier who have goals to increase their profits is the key to success in managing healthcare costs without reducing quality OR forcing higher costs to employees.

Many employers are currently providing healthcare benefits that their employees cannot afford to use which is counter to providing a plan that encourages annual examinations, disease management and elimination of preventable episodes that wind up in emergency rooms and intensive care. Just ask yourself, has your broker ever suggested providing more cost information or suggested bringing in a consultant to review alternatives? The irony is that these advisor consultants don’t do a lot of marketing-they spend their time working with their clients. We have built the relationships with the best in class advisors and provide introductions . Ironically, the advisors prefer to work with CFOs – we naturally gravitate to good data, risk analysis, analysis of alternatives and execution.

New Article

Featured on LVB.com

Can Medicare for All solve out-of-control health costs for businesses?

Forum Footage

Get an inside look from the CFO Forum on employee benefits.

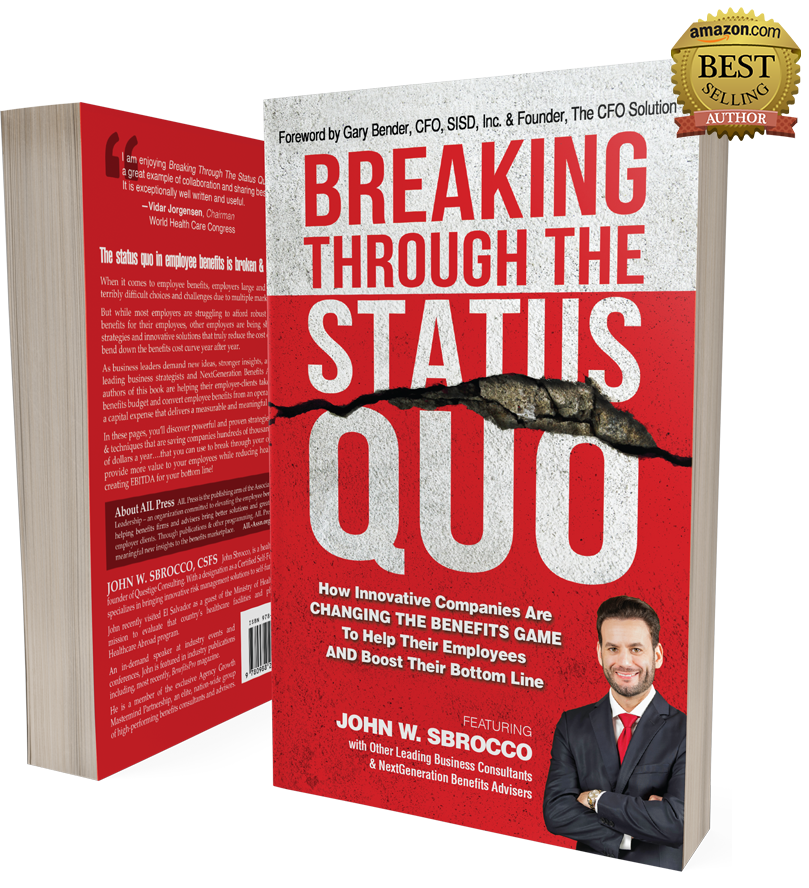

Breaking Through the Status Quo

Get an inside look from the CFO Forum on employee benefits.

As an author, John W. Sbrocco puts many of his most effective practices onto print. Breaking Through the Status Quo helps employers navigate the misinformed and misaligned state of employee benefits. Check below for a special offer for CFO Solution members. Foreword by Gary Bender.