Views From the Stream – Let’s Go Fly A Kite

When I was young, my parents took me to a wonderful, magical movie called Mary Poppins. It starred Julie Andrews and Dick Van Dyke with award-winning music from Richard and Robert Sherman. It had wonderful songs, such as A Spoonful of Sugar (Helps The Medicine Go Down) and Chim Chim Cher-ee, the latter of which won the Oscar for Best Song. And with Julie Andrews’s magical performance as Mary Poppins, not only did she win the Oscar for Best Actress, but the songwriters Richard and Robert Sherman won the Oscar for Best Music Score (Original). And, with the wonderful performances on all sides, the music, magic, and dance of the movie transformed the audience and was greeted with universal acclaim. This acclaim reflected the uplifting message of the movie in which the father and the children are transformed from a proper, prim, distanced group in early 1900s London to a close-knit, family. The movie ends with the rousing song, Let’s Go Fly A Kite, where the father takes his children to the park to fly a kite and Mary Poppins, having reunited the family, opens her umbrella and flies off to save the next family.

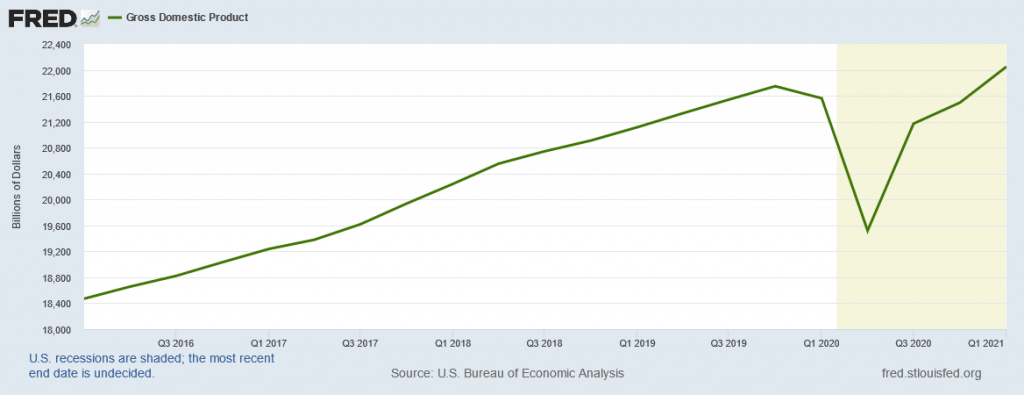

For those watching the US Economy over the past year, something magical has occurred. From the grim lockdowns put in place during the Spring of 2020 to combat the Pandemic, to the reopening of the economy over the past few months as vaccinations put the Pandemic to rest, the American economy underwent a mystical metamorphosis. Whether one looks to the restaurants, filled once more as people reclaim their lives, or at the beaches, with wall-to-wall bathers lying in the sun, the US economy continues to hit its stride. As the following chart demonstrates, Nominal GDP already hit a new high:

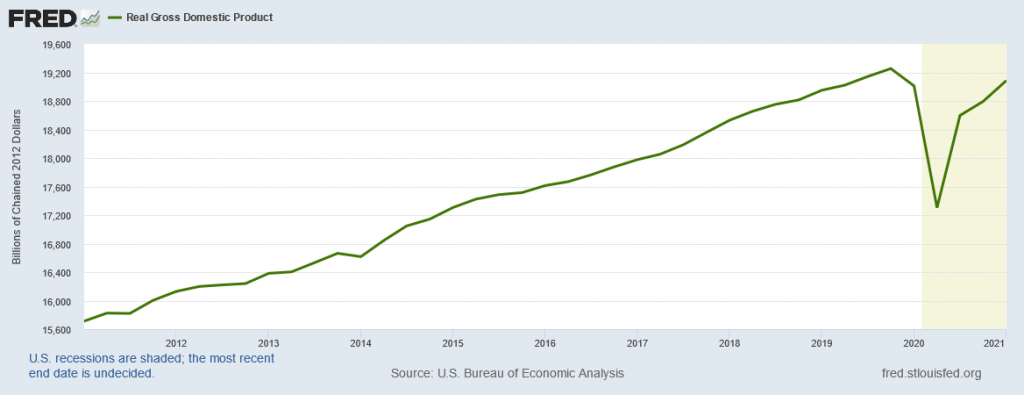

And, when measured in “Real Dollars”, which adjusts for inflation, Real GDP appears headed to new heights shortly:

In fact, at the end of Q1 2021, it stood less than 1% below the previous high in Q4 2019. And thus, as indicated in January, Real GDP should exceed its prior peak level in Q2 2021.

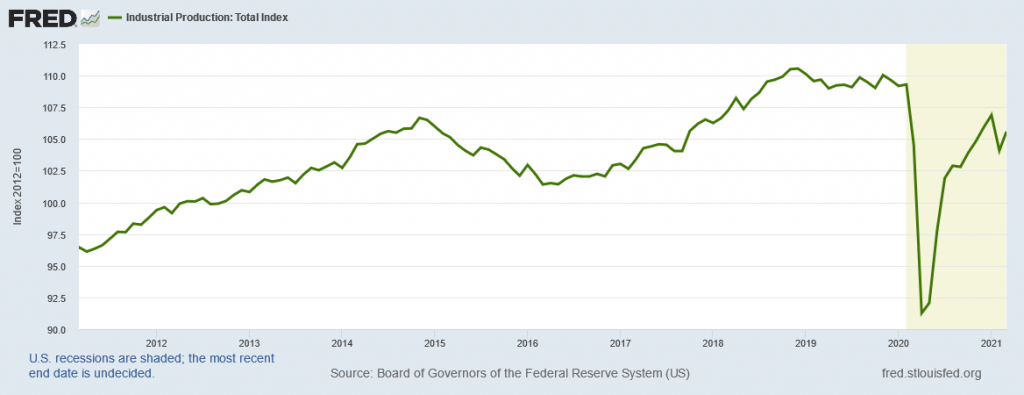

Other indicators of the economy continue to demonstrate strong underlying growth. Industrial Production through March, despite the massive freeze in February, already recovered 80%+ of its drop during the Pandemic:

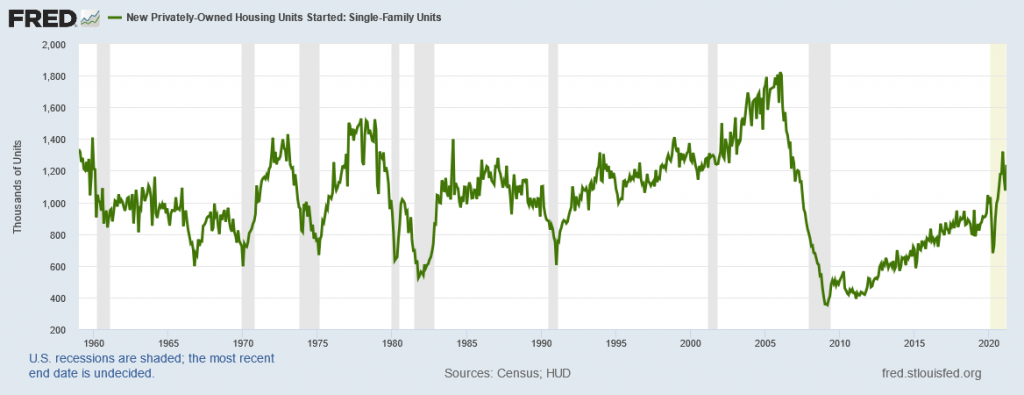

Forecasters project IP to exceed its prior peak before year-end. Single-Family Housing Starts stand back at their levels from the late 1990s and at a new high for this Housing Cycle. These levels were only exceeded during the Housing Bubble:

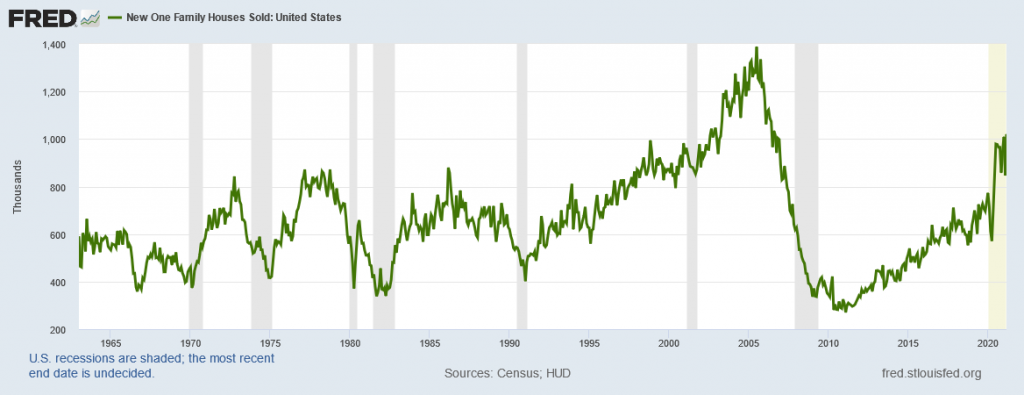

And New Single Family Home Sales continue extremely strong:

They were only exceeded from 2003 – 2006.

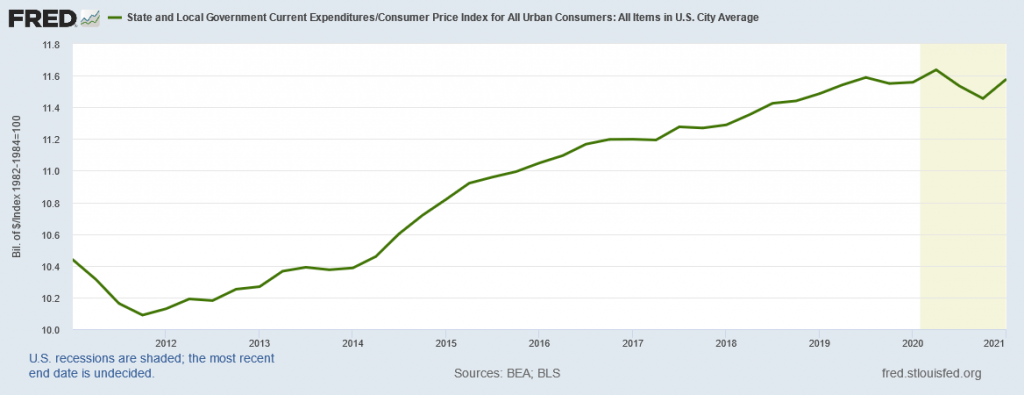

On the public side, Real State and Local Government Expenditures stand within 0.5% of their peak early in the recession:

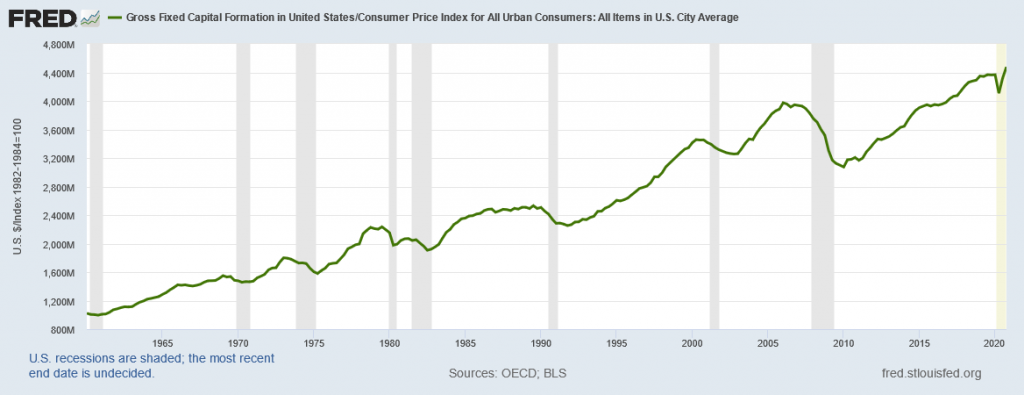

And lastly, Real Investment into the US economy stands at record levels, what economists would call Gross Fixed Capital Formation:

With all this data flashing Green, the US Economy appears headed up and to the right. And as the 11% of the economy related to leisure and travel continues to reopen, another whole layer of growth will add to the above data.

For the US, it appears a short, harsh winter has given way to a long, beautiful spring, replete with numerous flowers in brilliant bloom with dark green leaves on the trees. The heat of the summer, that will fade the blooms and the leaves, stands far away. And with the nourishing rains of spring in place, from both the US Government and Federal Reserve, rapid Economic Growth will continue. With all this in place, the US continues to metamorphosize from the dark greys and blacks of the Edwardian era to the bright colors of the Roaring ‘20s fashions. One can almost see the final scene of Mary Poppins, with its colored kites flying in the sky, and hear the rousing chorus of its final song rising as the family is reunited as one, singing together:

Let’s go fly a kite

Music and Lyrics by Richard M. Sherman & Robert B. Sherman

Up to the highest height!

Let’s go fly a kite and send it soaring

Up through the atmosphere

Up where the air is clear

Oh, let’s go fly a kite!

Music Written for Mary Poppins, 1964

Vaccination Passports To The Rescue

Last month we asked the following questions. “With Americans getting vaccinated at a rapid rate, the question seems: where are you going?” And then we pointed out that the true question might be: “Where can you go?” Well, given the number of those vaccinated, it appears governments in Europe and the US are moving to salvage the summer tourist season. For a country like Spain, where visitors to the country totaled 84 million in 2019 compared to a population of less than 47 million, this cannot come soon enough. The miracle solution appears Vaccination Passports. These would be verifiable government documents that would validate that someone was fully vaccinated and thus posed a low risk to get or transmit COVID. They would enable tourists to avoid 2-week quarantines and a variety of other rules imposed by governments to address the Pandemic that makes a tourist feel very unwelcome. From a practical standpoint, these rules ruin a vacation. Imagine arriving in Italy on a 10 day holiday, only to find out you were confined to your hotel for 2 weeks and could not see the Vatican in Rome or Michelangelo’s David in Florence while you were there. It might make more sense to travel within your own country than bother going to Italy. With this in mind, the US and EU continue to work hard to fix the problem and put a system in place at light speed. Thus, it may be only a matter of weeks until a British tourist can enjoy an Aperol Spritz on the Costa Del Sol in Spain. With tourists exhibiting a bad case of cabin fever, it appears a strong prescription of Vaccination Passports are coming To The Rescue, enabling all to regain their normal lives and bust out of the mandatory lockdowns citizens have endured over the past one and a half years.

Sell In May and Go Away

For those of us involved in the markets for many years, there is an old saying on Wall Street, “Sell In May and Go Away”. This saying originated in the old-time brokerage firms whereby the wealthy would retreat to their summer homes in the cities in order to avoid the summer outbreaks of disease in the cities, such as polio. They would return in the fall when the weather cooled down. However, this phrase also relates to a curious seasonality in the Equity Markets. From November 1 to April 30, the market tends to rise strongly, while from May 1 until October 31 the market performs much less strongly. Even though the former period outperformed only 63% of the time since 1950, the average outperformance over the entire period totals 5.47% per year. Given the almost 28% rise from November through April this past year and the tendency for strong performance to then see a period of digestion in the Markets, as the real economy catches up, for long term investors in the Equity Markets, it may truly become a year to “Sell In May and Go Away”.

Upcoming Speaking Events

Our “live” Public Speaking continues to accelerate in 2021 as groups have adjusted to the Zoom and Skype dominated world. Recent appearances include several private investor groups and associations. Upcoming appearances include a number of C Level Executive groups, industry associations, and investor groups. Having received our first shot and scheduled to receive our second shot on April 12, we looked forward to appearing live at the United States National Strategy Seminar in June in Carlisle, PA. Unfortunately, despite vaccinations accelerating, the event will now occur via Zoom and not live. However, we look forward to the fall and getting up in front of a large audience once more. As to speaking for your group, either Zoom or live, please feel free to contact us. We would be happy to accommodate your needs.

Monthly Letter Preview

This Month, we provide perspective on the Commodity Markets and a further installation in our Great Game of Power Series:

- Commodities: Thank You for the Green Energy Driven Boom – We take a look at Green Energy and how the wholesale move to these technologies likely will create a commodity boom. These technologies are surprisingly commodity intensive and thus, with their rapid adoption, they create a Demand Shock for a variety of Commodities. With mine exploration and development taking years, such a Demand Shock will likely produce a multi-year period of Supply chasing Demand.

- The Great Game of Power: The Cuban Missile Crisis, The South China Sea, & The Contest for Global Dominance – The South China Sea continues to heat up. China, since the change in US Administration, continues to ramp up its challenge to the U.S. as a test of the Biden Administration. This comes in the form of rising violations of Taiwan’s airspace and increasing encroachment into The Philippines territorial waters. With the US possessing a Mutual Defense Treaty with The Philippines and an obligation under the Taiwan Relations Act “to resist any resort to force or other forms of coercion that would jeopardize the security, or the social or economic system, of the people on Taiwan”, a potential confrontation with China, similar to the Cuban Missile Crisis, could erupt at any time.

As always, we end the Monthly Letter with Economic Observations on the US Economy through Interesting Data Points that provide color on the happenings in America. The link to the Monthly Letter is:

https://greendrakeadvisors.com/views-from-the-stream-may-2021/

Should you have any questions on how the above issues or the items discussed in our accompanying Monthly Views From the Stream Letter impact your family’s financial position or your business’s future as well as the potential actions you could take in response, please do not hesitate to contact us. We welcome the opportunity to discuss this with you.

Yours Truly,

Paul L. Sloate

Chief Executive Officer